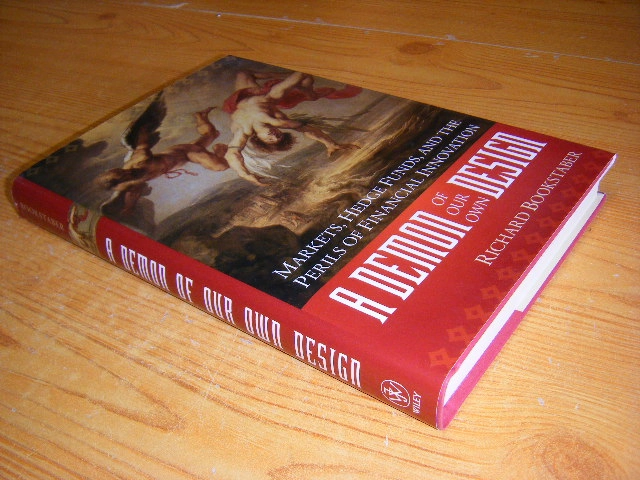

A Demon of Our Own Design, Markets, Hedge Funds, and the Perils of Financial Innovation

Richard Bookstaber;Hardback met stofomslag in zeer goede staat. Engelstalig.

It's Wall Street's most painful paradox. Investors are more sophisticated than ever, are enabled by unprecedented technology, and protected by more government oversight and regulation than at any other time in history. Yet Wall Street is becoming a riskier and riskier place. Crashes and catastrophic losses seem commonplace. Hedge funds wreck on the financial shoals with a disturbingly familiar pattern. Worse, today's financial crises do not arise from economic instability or acts of nature, but from the very design of the financial markets themselves.

In A Demon of Our Own Design, Richard Bookstaber paints a vivid picture of a financial world that is ever edging toward disaster. As a hedge fund 'rocket scientist,' Bookstaber provides an insider's perspective to the tumultuous management decisions made by some of the world's most powerful financial figures from Warren Buffett to Sandy Weill to John Meriwether,as well as recounting his own contribution to market calamities. He designed some of the complex options and derivatives that, combined with the globalization of the world's markets and the ever-increasing speed of transactions, allow markets to slide out of control. And he explains why the best efforts of institutions on the front lines to create safeguards, manage risk, and regulate the markets may end up contributing to instability. Bookstaber argues that many of the financial innovations and regulations that are supposed to level the playing field instead make the markets more dangerous for all the players, big and small.

Drawing on his intimate knowledge of such infamous disasters as the 1987 Crash and the demise of Long-Term Capital Management, Bookstaber identifies the key areas that make markets vulnerable: liquidity that begets greater leverage; innovation that creates greater complexity; and a structure that demands a nonhuman level of rationality. The twofold solution he suggests—reducing complexity and breaking the tight coupling of transactions—goes against the prevailing winds of Wall Street, but will lead to a more robust and survivable market.

Aantal beschikbaar:

0

Staat:

Zeer goed

ISBN:

9780471227274

Taal:

en

Jaar van uitgifte:

2007

Uitgever:

John Wiley & Sons

Druk:

Reprint

Magazijn locatie:

H24P724B

Boeknummer:

232659

Pagina's:

276

Extra korting

%

Meer boeken is meer korting!

- Vanaf 5 boeken

- Vanaf 10 boeken

- Vanaf 15 boeken

- Vanaf 20 boeken

- 5% korting

- 10% korting

- 15% korting

- 20% korting

Bekeken titels

Bekeken titels

Gratis verzending vanaf €25 (NL)

Boek2 heeft als missie veel goede boeken in omloop te houden

Ruim 18 jaar ervaring

check_circle

check_circle